Streaming service launch benchmarks 2026

In 2025, streaming crossed a line it had been racing toward for more than a decade. For the first time, streaming usage surpassed the combined total of cable and broadcast TV. Not by a little, but decisively. Streaming became the default way people consume video.

That milestone marked the end of one era and the beginning of another.

Because when streaming becomes the majority, the rules change. User expectations rise. Switching costs drop. Loyalty becomes harder to earn. And for any new streaming service launching in 2026, the question is no longer whether people are willing to stream. It is whether they are willing to stay with you.

The early months after launch are where this battle is won or lost. Users arrive curious but impatient. Content libraries are compared instantly. Experiences are judged in minutes, not weeks. The platforms that survive are not the ones with the biggest launch splash, but the ones that understand their early signals and act on them fast.

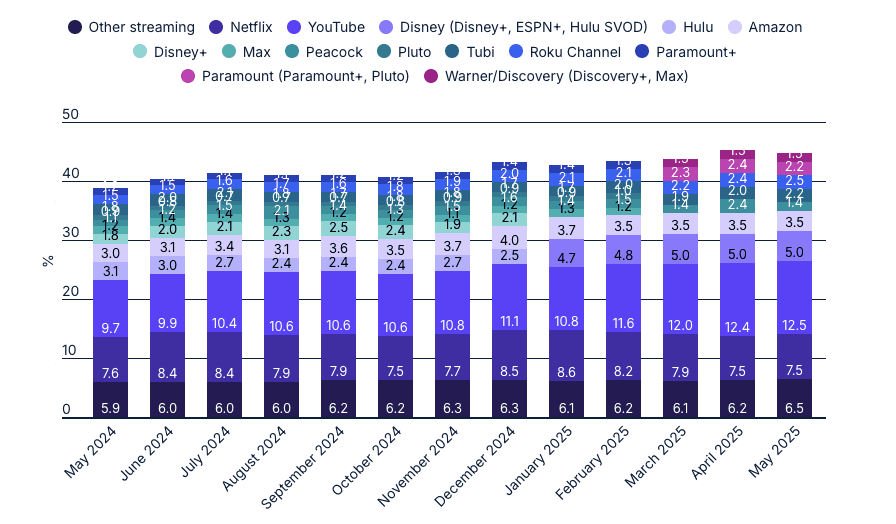

As the chart shows, streaming’s share of total TV usage continued to climb steadily through 2024 and into 2025, reinforcing that streaming is no longer the challenger category but the dominant consumption model new platforms must compete within.

Below are four launch benchmarks every new streaming service should monitor closely in their first 12 months. Alongside each one, you will see how social and shared experiences powered by AiFi can directly influence acquisition efficiency, retention, and long-term value.

1. Customer Acquisition Cost (CAC)

CAC is the total cost of acquiring one paying subscriber. For new streaming platforms, this metric often feels unstable at first. Campaigns are still being tested, positioning is still evolving, and audiences are still learning who you are.

But CAC is not just a marketing efficiency number. It is a reflection of how compelling your product is in the real world.

What healthy CAC looks like for new streaming platforms

- Excellent Acquisition costs are low relative to subscriber lifetime value, indicating strong product-market fit and clear messaging.

- Healthy Acquisition costs are balanced and predictable, with lifetime value comfortably supporting continued growth.

- Warning sign Acquisition costs are rising faster than lifetime value, often pointing to weak differentiation, unclear positioning, or onboarding friction.

How AiFi helps reduce CAC over time

Acquisition is not only about paid channels. It is about organic pull.

AiFi enables shared listening and viewing moments that turn individual users into groups of users. When people experience content together, they talk about it. They invite others. They create moments that naturally travel outside the app.

This leads to:

- More referrals

- More shared sessions

- More organic acquisition

AiFi does not eliminate paid CAC on day one, but it lowers blended CAC over time by embedding social behavior directly into the product.

Read about the AiFi half CAC model here

2. 30-Day Churn

Most new streaming services underestimate how much early churn hurts. If too many users cancel in the first month, your entire funnel becomes inefficient.

Good ranges to aim for

- World-class: Under 8 percent

- Healthy: 8 to 15 percent

- Warning: Above 15 percent

The biggest reason new users leave is simple:

They don’t build a habit.

AiFi changes this by enabling:

- Watch or listen parties

- Social group sessions

- Friend-driven discovery

- Shared playlists and shared content moments

When people experience content together, they stick around longer. And when groups return, churn drops dramatically.

This is where AiFi becomes a retention engine, not just a feature.

For proven retention playbooks, check out How a Music Streaming Platform Boosted Retention by 146%

3. Time to First Stream (TTFS)

TTFS measures how quickly a new user reaches their first meaningful moment: pressing play. If this moment is delayed, churn follows. If it happens fast, activation rises.

TTFS targets for 2026 launches

- Excellent: 1 to 2 minutes

- Healthy: 3 to 5 minutes

- Warning: Over 5 minutes, or if fewer than 60 percent stream in their first session

How AiFi shortens TTFS

AiFi can auto-detect nearby devices and offer a one-click “Join Group Session.” This means a new user doesn’t have to browse, search, or decide. They simply join the experience already happening around them.

That cuts TTFS significantly and boosts the emotional impact of the first session.

See AiFi in Action to understand how fast-to-value experiences feel in real use cases.

4. DAU/MAU (Stickiness)

DAU/MAU shows how often your monthly users return. For streaming platforms, strong stickiness means people build weekly habits.

Good DAU/MAU ranges for new platforms

- Excellent: 40 to 60 percent

- Healthy: 25 to 40 percent

- Warning: Under 25 percent

This is closely tied to second-screen behavior, where streaming becomes part of a broader social and mobile routine rather than a single-screen activity. Second Screen Behaviour: The Future of Streaming Engagement explores why this shift is critical for retention.

AiFi as a stickiness multiplier

People do not return to apps.

They return to moments.

When users know something is happening, they come back. Not because of reminders, but because they feel invited.

AiFi makes this possible by enabling:

-

Recurring group sessions

-

Moments where users naturally invite others

-

A sense of presence inside the app

-

Weekly rituals built around shared content

This is where AiFi turns streaming from a solo activity into a social habit.

Instead of asking users to remember your platform, it gives them a reason to return.

Learn more about how AiFI works.